Here are some options to connect to our IRC server to chat with like-minded people.

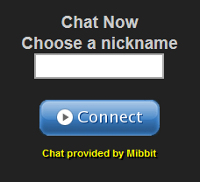

Connect here using Mibbit

NOTE: You need to allow pop-ups to view, or use your own chat program using the alternative method.

Connect with your own IRC Client

Here is the information you need to know in order to connect to our servers using your favorite IRC software package:

*Server: chat.cauponium.com

*SSL ports: 6697 or Default port 6667

*SSL:yes; accept invalid certificate

Please Note:

NO SPAMMING OR UNAUTHORIZED ADVERTISING IS ALLOWED (INCLUDING BUT NOT LIMITED TO AFFILIATE MARKETING). WE WILL ENFORCE THIS AND MAY DO SO WITHOUT WARNING.

FAQ:

- How To Join A Chat Room : /join #RoomName

- How To Register Your Name : /nickserv help

- How To Register A Chat Room : /chanserv help

For a list of comprehensive IRC Clients that can be used to connect to Ircforex, please visit here.

No support for these products is provided by CAUPONIUM.

If you continue to have issues and want to use a web chat interface, then please use the Mibbit Chat.

Recent Comments